The Swiss National Bank (SNB ) is leaving the key interest rate at the current level of 1.75 percent. This ends the series of increases for the time being. For many, the decision comes as a surprise, but it is the right move given the weak economic outlook. What impact will the decision have on property owners and buyers?

Table of contents

Toggle

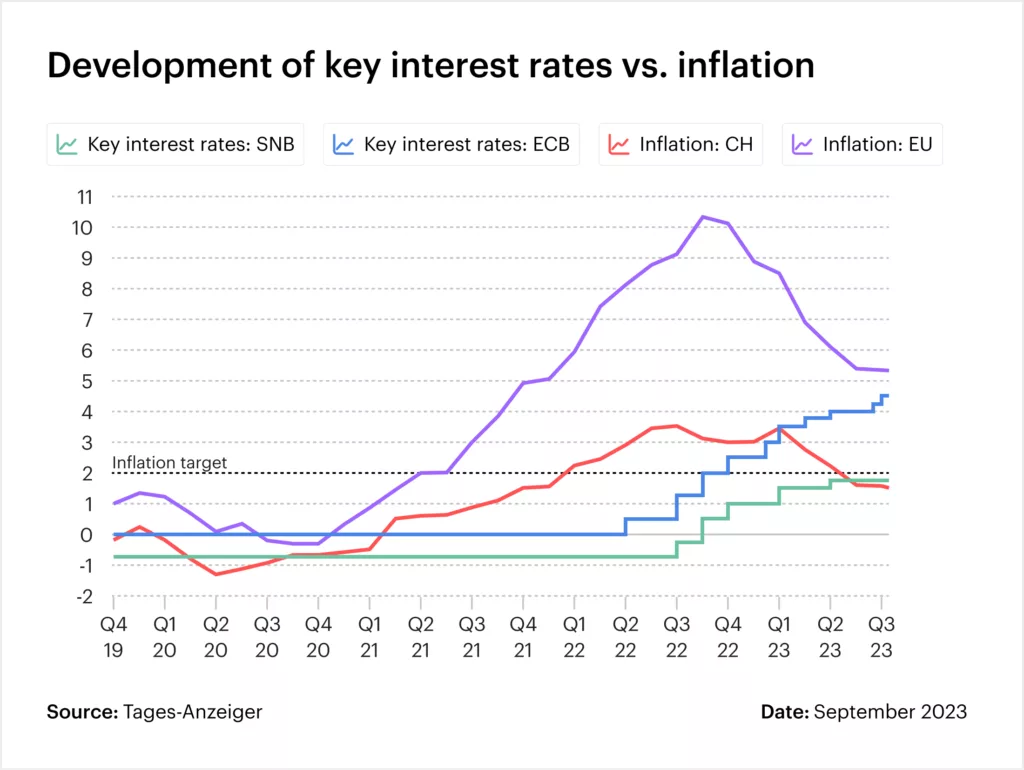

Source: Tages-Anzeiger

Stability despite inflation

Since August, Switzerland has recorded an annual inflation rate of 1.6 percent, which is within the range of zero to two percent set by the Swiss National Bank (SNB). Contrary to the measures taken by the European Central Bank (ECB), which recently raised its key interest rate, the SNB decided to keep its key interest rate stable. This could result in a further strengthening of the Swiss franc against the euro as the interest rate differential grows.

Despite this measure, inflation remains a key concern and there are fears that housing costs could continue to rise, especially in light of the rent increases announced for October. However, the unchanged key interest rate can ensure a certain stability in the market and reduce the burden of mortgages and loans, which could keep demand for real estate constant.

Effects of the unchanged key interest rate

- Mortgages: Mortgage interest rates are likely to remain stable for the time being or possibly even fall if the interest rate increase had already been factored into current offers. This stability benefits both current and potential property owners, as they do not have to fear any additional burden from rising mortgage interest rates for the time being.

- Real estate prices: Real estate prices should now be less exposed to strong fluctuations as financing costs remain stable.

- Rents: There should be few reasons for further rent increases for the time being. It remains to be seen how the reference interest rate will develop as a result of this decision.

- Borrowing costs: Borrowing costs will remain constant for the time being, which could encourage more stable demand for consumer goods and investments.

- Inflation: Despite current developments, a moderate increase in inflation is expected, although this is independent of the interest rate decision and is more likely to be influenced by administrative factors.

Effects on property owners

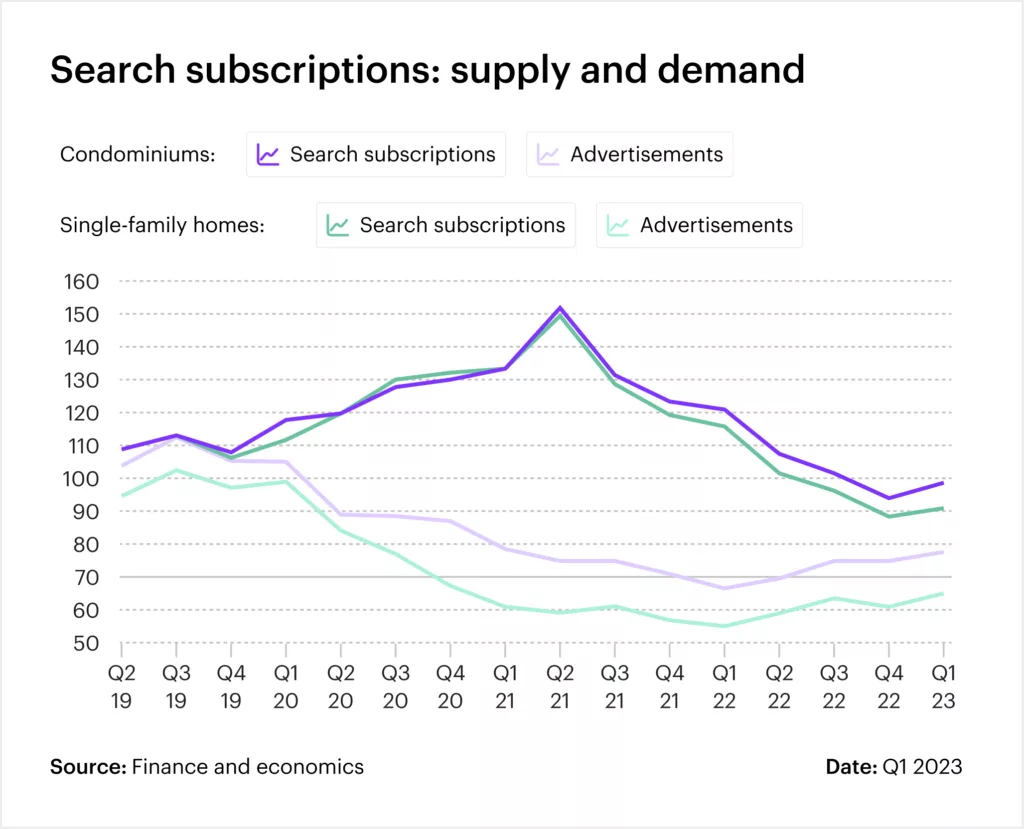

Today’s decision by the SNB could be relieving news for property owners, as it means that mortgage interest rates will remain stable for the time being. In addition, real estate prices are likely to be less volatile, which in turn means value stability for existing property owners. For those who need to renegotiate their mortgages, this could be an opportunity. The unchanged key interest rate should also help to ensure that demand for real estate remains at the current level or rises again slightly. Property owners who are planning to sell their property in the near future can therefore expect more stable demand and therefore a more stable price level.

Effects on potential buyers

For potential buyers, the stability of the key interest rate could be good news, as affordability is becoming increasingly difficult for many. With the non-increase, home seekers have more time to find a suitable property without having to worry about rising interest rates affecting affordability. However, potential buyers should also keep an eye on the development of real estate prices, as constant demand could keep prices at a high level.

Source: Finance and Economy

Comparison Switzerland vs. EU / Will the SNB continue to raise the key interest rate?

The SNB’s decision is in contrast to the ECB‘s current policy. While the ECB has raised key interest rates to combat inflation, the SNB has chosen a different path. It remains to be seen whether and when the SNB will adjust its policy, particularly in view of developments in the EU and inflation rates in Switzerland and the eurozone.

Conclusion

The SNB’s decision to keep the key interest rate constant could be seen as a sign of stability and confidence in the current economic situation. However, property owners and potential buyers should keep a close eye on developments, as future changes cannot be ruled out. The SNB’s next steps will certainly depend on developments on the global markets and the economic situation in Switzerland.

Let the experts guide you. We are at your side for questions and non-binding advice. Arrange a consultation directly or call us on +41 44 244 32 00.

All data are without guarantee. The information on these Internet pages has been carefully researched. Nevertheless, no liability can be assumed for the accuracy of the information provided.