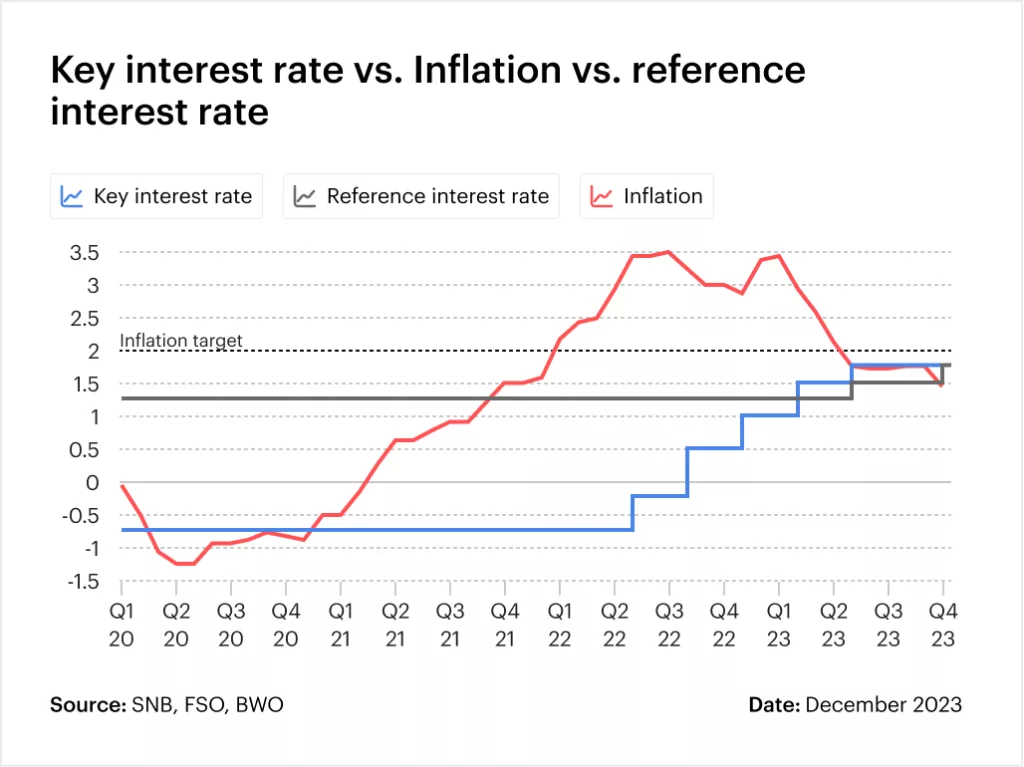

In its latest monetary policy assessment, the Swiss National Bank (SNB) decided to leave the key interest rate unchanged at 1.75%. At a time of financial uncertainty, this decision reflects the complex balance that the SNB is striving for in its monetary policy. What does the continued stability of the key interest rate at its current level mean for real estate owners and buyers?

Table of contents

Toggle

Constant interest rates for more planning security

For property owners, constant interest rates, even if they are still high at the moment, mean a certain degree of planning security for budgeting and long-term financial commitments such as a mortgage. For real estate buyers, on the other hand, the stability offers a good opportunity to better evaluate financing options in order to enter the market. The trend of falling mortgage interest rates has been intensifying for several months and has now reached a level last seen in the summer of 2022. A fixed-rate mortgage with a term of 10 years can currently be taken out at an interest rate of less than 1.8 percent.

For real estate owners, the easing inflationary pressure means a certain stability, in contrast to previous forecasts. This could open up new opportunities, especially for owners of expiring mortgages. At the same time, according to the latest findings of the national consumer price index (CPI), some cost centers have fallen unexpectedly. Nevertheless, cost increases in the areas of energy, transport and VAT are already expected in the coming year, which is likely to reduce purchasing power again.

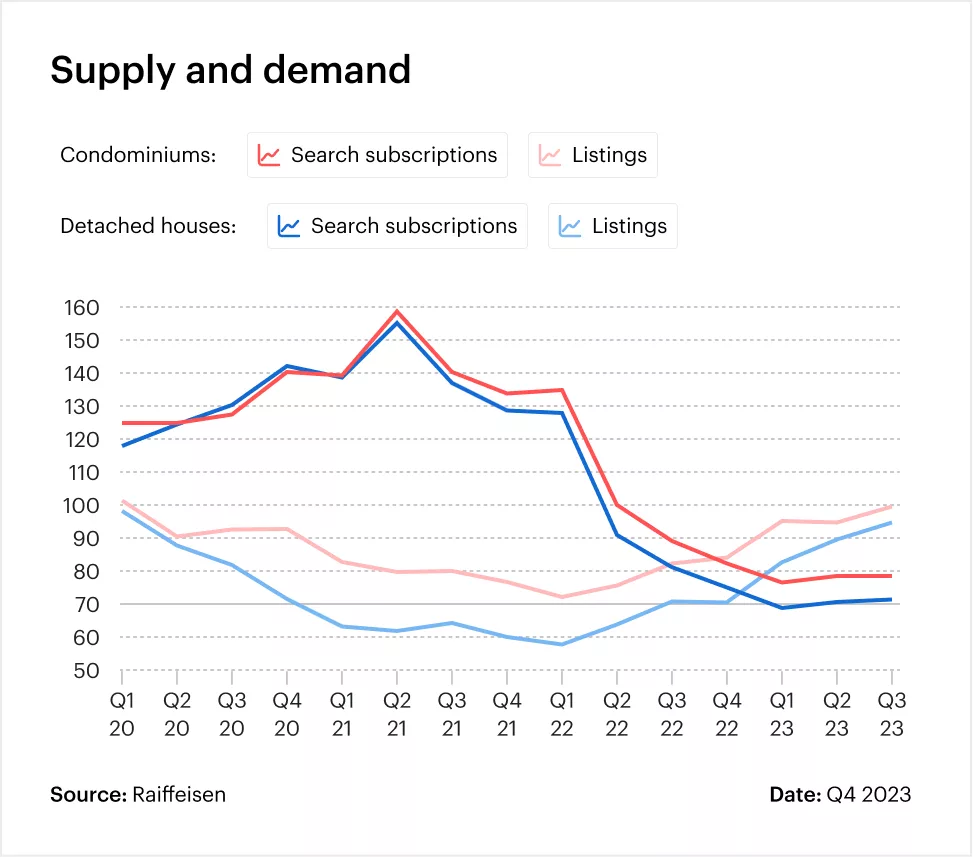

How is the market for the sale of real estate developing?

Demand has fallen sharply and has only recovered slightly in recent months, while at the same time there has been an increase in properties for sale. Despite these developments, there have been no short-term panic sales and homeowners are sticking to their asking prices. This is reflected in particular in the number of vacant owner-occupied homes, which have increased slightly since the turnaround in interest rates. Owners who want to sell a property in the near future should be prepared to adjust their price expectations and bring them into line with current demand.

Source: Raiffeisen

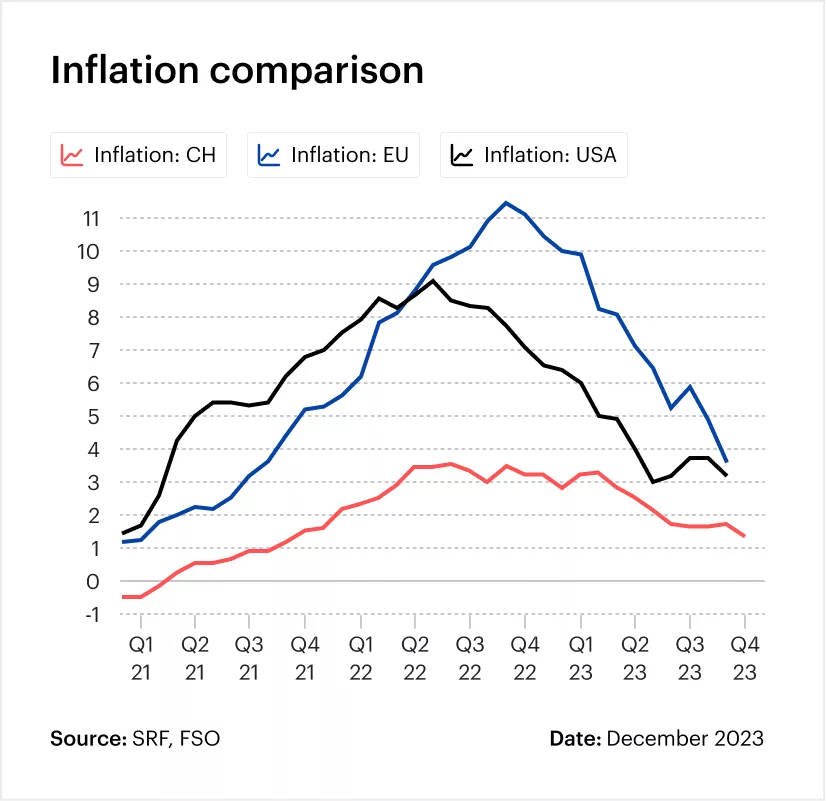

Comparison Switzerland vs. EU & USA

As a country with a strong international network, Switzerland also pays particular attention to the development of the global economy. An international comparison shows that Switzerland is taking a more conservative approach than other global economic zones. While interest rates have risen to 4% in the eurozone and 5.38% in the USA, Switzerland has taken a more cautious approach to raising interest rates. This financial strategy is also reflected in the inflation rate.

Switzerland has comparatively moderate inflation compared to the EU (with a high of 11.5%) and the USA (with a high of 9.1%). While a real estate crisis is looming in Germany due to rising financing and construction costs as well as new regulations, the real estate market in Switzerland remains solid despite global challenges.

Conclusion

The SNB’s decision to leave the key interest rate at 1.75% is a positive signal for homeowners and buyers alike. Renowned economists have also recently adjusted their previously gloomy forecast for next year and expect the first cut in the key interest rate as early as next summer. Until then, however, it should remain stable. In the future, it will be crucial to continue monitoring and analyzing the development of interest rates in order to make informed decisions. A comprehensive understanding of local market conditions is also crucial for successful sales in the current market situation.

Let the experts guide you. We are at your side for questions and non-binding advice. Arrange a consultation directly or call us on +41 44 244 32 00.

All data are without guarantee. The information on these Internet pages has been carefully researched. Nevertheless, no liability can be assumed for the accuracy of the information provided.