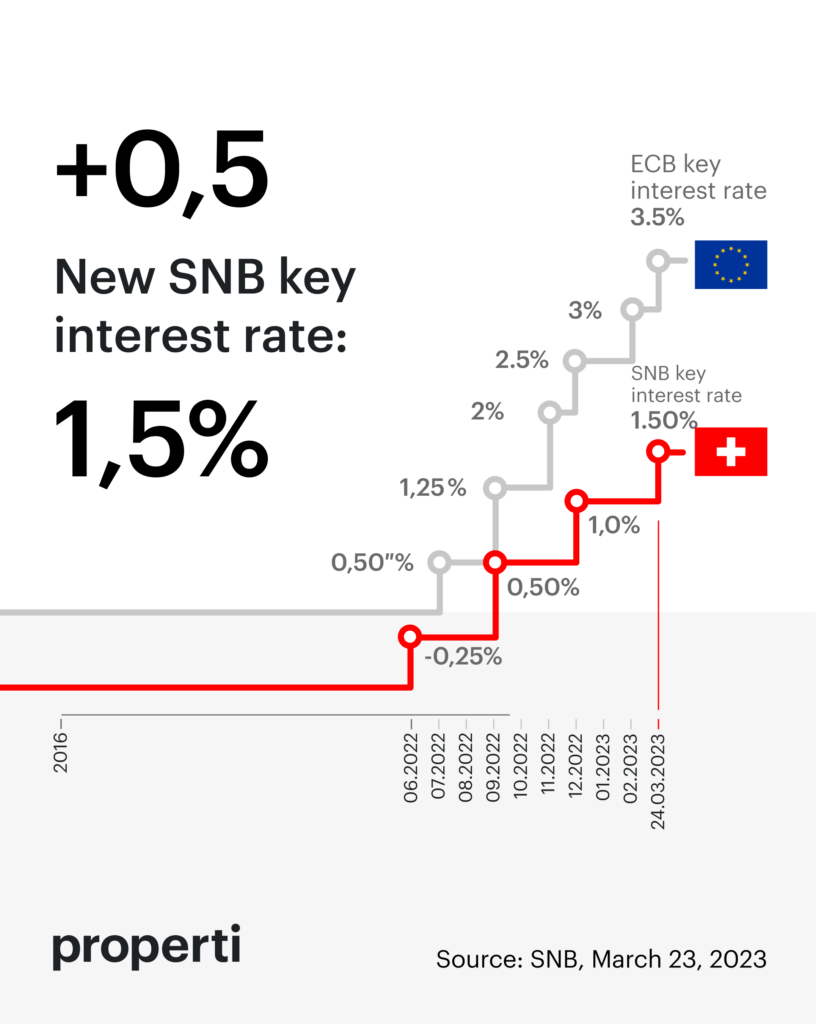

This Thursday, the Swiss National Bank (SNB) raised the key interest rate again by 0.5 percentage points to 1.5 percent. In this way, it wants to counter inflation, which rose again in February to 3.4 percent – and it does not rule out further interest rate hikes. Thomas Jordan, President of the SNB, explained that the monetary policy assessment took place in an extraordinary situation. Last week, confidence in Credit Suisse was shaken, which could have repercussions for the financial sector and the economy as a whole. But how will the key interest rate hike affect the real estate sector?

Table of contents

ToggleAn overview

According to the Federal Statistical Office (Bfs), inflation rose by 3.4 percent in February compared to the same month last year. This is moderate by international standards: In Europe, inflation is over eight percent, in the USA over six percent. In order to keep the level of the Swiss franc globally stable and to remain internationally economically viable, a renewed increase in key interest rates was to be expected. The end of the negative interest rates of the past eight years is thus finally sealed. This is a paradigm shift in monetary policy, which can currently be observed not only in Switzerland, but also in Germany and the USA. To understand how this increase will affect the real estate market, it is important to understand what exactly is behind it.

The goal of monetary policy strategy is price stability. When interest rates are low, as they have been in recent years, the amount of money in circulation increases because it is cheap to withdraw money and borrow money from the bank. When more money is spent, prices increase in the long run because demand determines supply. This is the inflation we are currently seeing internationally. An increase in the prime rate is meant to counter inflation. If it becomes more expensive to borrow money, fewer people do so and their money stays at the bank. In technical jargon, this is known as a contractionary phase: people save, and the amount of money in circulation falls.

And real estate prices?

Such a key interest rate increase has not come out of nowhere, but has been looming for some time. The markets have mostly already announced this development. Nevertheless, the situation is challenging, especially for the real estate sector, because a move in the prime rate also moves the mortgage rate. Between the beginning of 2022 and the end of 2022, the benchmark interest rates for 10-year fixed-rate mortgages in Switzerland increased by 1.5 percent. Economic institutes forecast a further increase. This means that financing a property will become more expensive: The greatest impact of the interest rate increase will be felt above all by potential buyers, but also by owners.

It is difficult to make accurate forecasts at this stage, but it can be assumed that there will be little change in the Swiss real estate market. There are many reasons for this. For one thing, interest rates are still moderate from a historical perspective. The decisive factor, however, is that there is still a slight surplus of demand in the owner-occupied home segment. This means that more people want to buy real estate than are offered on the market. In addition, immigration is high. More people means more demand for housing: the short supply therefore supports the market.

Changes in the mortgage market

What will change, however, is the need for mortgage maturities. It is possible that buyers will increasingly rely on SARON mortgages in the future because they do not have fixed terms and interest rates and can therefore adapt to the volatile situation. Owner:ins will extend their current mortgage to secure low interest rates for the long term. And salespeople:inside? They can rely on the equity in Switzerland, because healthy fundamentals and intact rental markets, as well as a generally tight supply, ensure the stability of the market.

Keeping an eye on the decline in demand and price development

Even though the key interest rate increase is causing uncertainty and will also cause mortgage rates to rise in the medium term, there is little cause for concern. Because with the increase in interest rates, another phenomenon will also be observed: The decline in demand. If demand is lower, then at some point property prices will also fall again, offsetting the increased inflation. Potential buyers are advised at this point to keep an eye on price developments and to find out what financing options are available. Sellers sometimes do not have to worry, because demand still exceeds supply. However, the real estate market will change in the short term in that demand for rental housing will increase even further. Sellers should also be prepared for this.

The fact that the key interest rate increase will influence purchasing decisions is a fact, but more of an opportunity than a problem. Fluctuations in the market have always existed. This will continue to be the case in the future. Just like the fact that people need to live and want to buy. When general conditions change, it can be frightening. At this point, optimal advice and transparency is a possible step towards more security. Crisis also means movement, and movement is primarily a good thing. Also when it comes to the key interest rate, because everything that is intended to ensure price stability in the first step brings more security in the second step, and security is the basis for all buying and selling decisions.

You have questions and would like a non-binding and free consultation? Arrange a consultation appointment directly or call us: +41 44 244 32 00

All data are without guarantee. The information on these Internet pages has been carefully researched. Nevertheless, no liability can be assumed for the accuracy of the information provided.