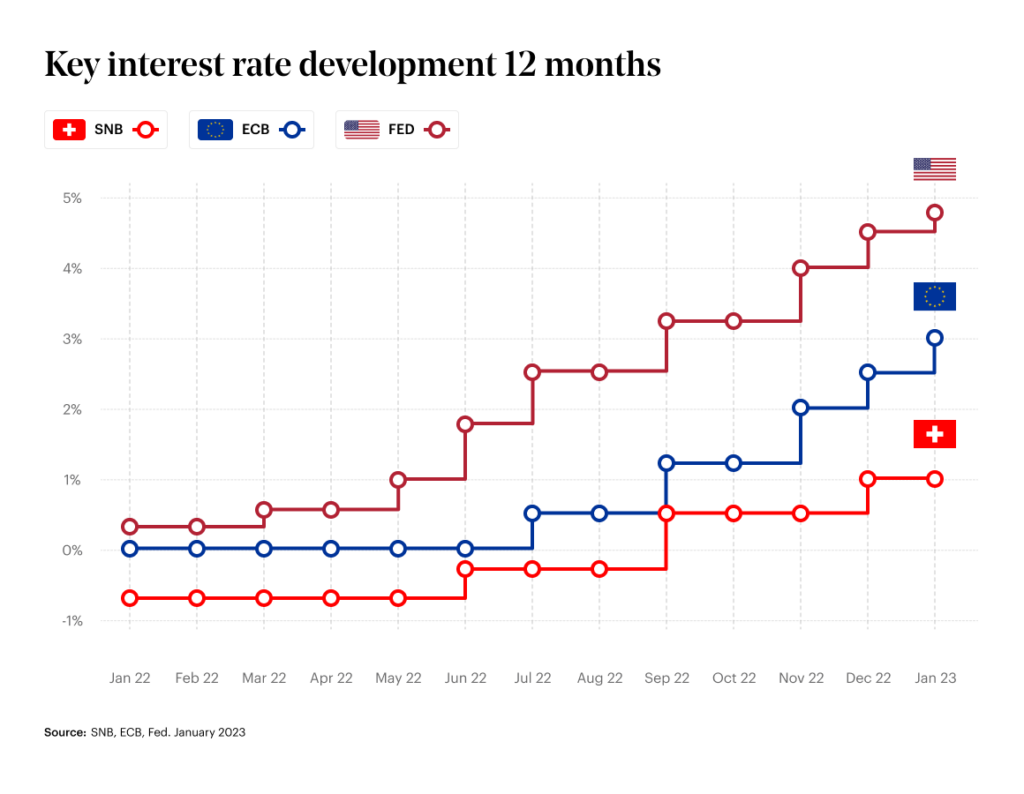

The Federal Reserve has increased its target interest rate by 25 basis points. This was the eighth increase since March 2022, raising the policy rate to 4.75 percent, the highest since October 2007. The European Central Bank is also sticking to its course and raising the key interest rate to 3 percent. What does this step mean for the Swiss real estate market?

Table of contents

ToggleImpact on the Swiss real estate market

Last year was characterised by the global turnaround in interest rates, which is why the property market is under increasing pressure in terms of prices and financing. The Swiss National Bank (SNB) intervened, heralding the end of the negative interest rate policy. And yet the potential decline in the systematically relevant property markets poses a significant risk to the global economy. This is due to the impact of higher interest rates, which can affect the financial situation of private households and reinforce the downward trend in property prices. While flat prices are still holding up or moving sideways according to the IAZI, single-family homes are showing initial price declines.

The new financial reality

In Switzerland, a large proportion of mortgage borrowers have already opted for Saron mortgages, as was already apparent in the first half of last year, according to mortgage experts. Owners of owner-occupied homes who are forced to renew their fixed-rate mortgages are not particularly pleased regarding the current turnaround in interest rates. Although current interest rates for long-term fixed-rate mortgages are within the affordability rules, they range from 4 to 5 percent. In the past, many households were “seduced” by record low interest rates – if there are no reserves now, confronting the new financial situation can have consequences. Careful planning with experts, regarding budgeting or intended sale of the property, is essential.

US interest rate decision Fed

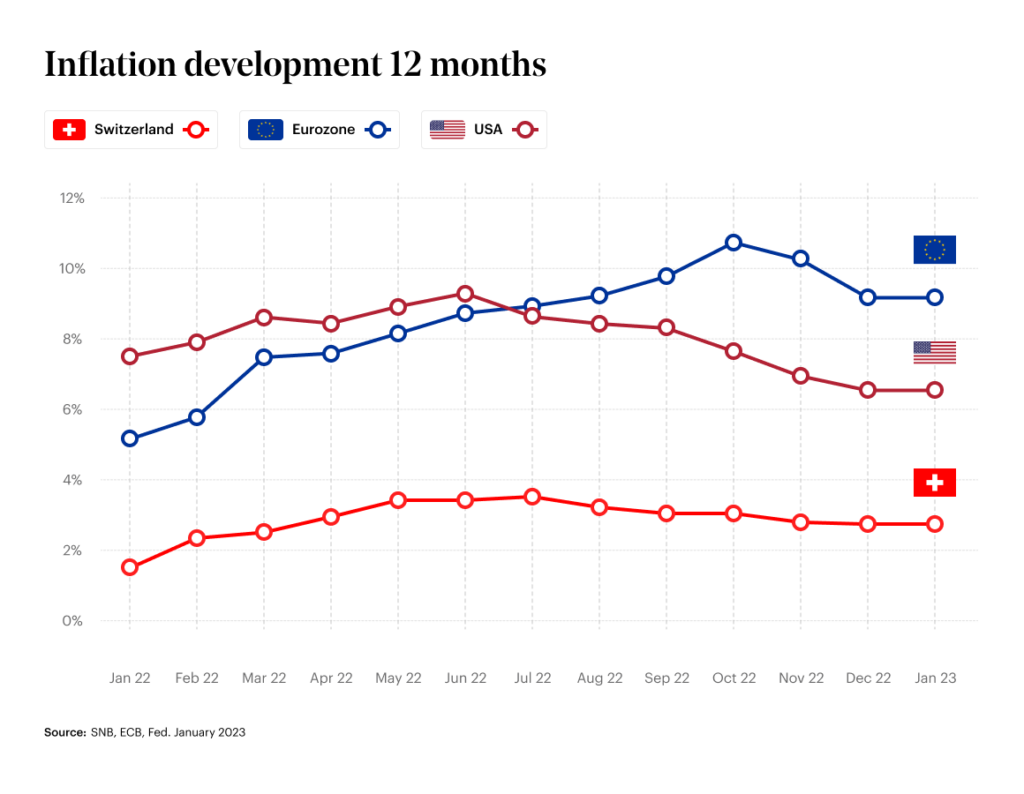

The U.S. central bank, the Federal Reserve (Fed), aims to use interest rate hikes to reduce inflation in the United States, which is still at its highest level since the early 1980s despite recent signs of cooling. A Fed statement, an explicit acknowledgment of progress in reducing price increases from peak levels, said inflation has moderated somewhat but remains elevated. “Inflation data over the past three months show an encouraging reduction in the monthly increase,” Fed Chairman Jerome Powell said in a press conference. “And while recent developments are encouraging, we need significantly more ‘evidence’ to be sure that inflation is on a sustained downward path.”

Still, the Fed stressed that the U.S. economy is enjoying “moderate growth” and “robust” employment gains, and policymakers remain “highly attentive to inflation risks.” The Federal Open Market Committee expects that continued increases in the target range will be appropriate to achieve a stance of monetary policy that is sufficiently restrictive to bring inflation back to two percent over the longer term, according to a statement.

EU interest rate decision ECB

Today, Thursday, was the next regulatory action of the ECB, led by President Christine Lagarde.

Compared with the U.S.A., a larger interest rate step was expected for Europe, which was confirmed with an increase of 0.5 percentage points. This was due to the still higher level of inflation in the euro zone, estimated at 8.5 percent in January. This represents the fifth consecutive increase and underscores the ECB’s commitment to countering stable inflation in the euro area. The interest rate thus reached its highest level since the financial crisis. A further step in the same amount is already announced by the ECB for March.

What are the steps taken by the Swiss National Bank

It is still unclear what impact the increase in the target interest rate by the U.S. Federal Reserve and the European Central Bank will have on the Swiss National Bank. The SNB will not make a decision regarding the key interest rate until early March. Currently, it is assumed that a tightening will take place, as SNB chief Thomas Jordan recently indicated in an interview with “Bloomberg Television”.

In general, the Swiss National Bank’s response to interest rate decisions by other central banks may be influenced by a variety of factors, including the economic situation in Switzerland and in other countries, as well as evolving political and financial uncertainties.

Challenge for real estate buyers and owners

Investors agree that higher capital costs can lead to potential volatility as sellers and buyers adjust their price expectations. The two most important questions are how the higher cost of capital will affect pricing and transaction volumes in the short term. The consequences will vary depending on the market segment and the object. Higher interest rates are a challenge for both homebuyers, who face higher monthly payments, and sellers, who face lower demand and/or lower offers on their homes.

How much do mortgage rates affect housing demand?

There is no doubt that record low mortgage rates have fueled the real estate boom of 2020 and 2021. Some believe that this was the most important factor that drove the residential real estate market higher.

Then, at the end of 2022, mortgage rates rose more than they had in two decades, and the housing market slowed dramatically. Economists expect prices to fall by a few percentage points.

Central bank decisions: The decisions of central banks, including the setting of interest rates and the regulation of money and credit markets.

Business cycles: booms and busts in the economy can have an impact on the financial markets, especially the currency and equity markets

Geopolitical tensions: Conflict, war, political instability and policy choices

Natural disasters: Floods, earthquakes, hurricanes, etc.

Changes in the regulatory framework: Changes in the regulatory framework, including the introduction of new laws and regulations.

Economic Indicators: Key economic indicators such as gross domestic product, inflation rate and unemployment rate.

For homeowners and anyone interested in property: Subscribe to our newsletter and never miss any news about the Swiss property market.

All data are without guarantee. The information on these Internet pages has been carefully researched. Nevertheless, no liability can be assumed for the accuracy of the information provided.