With rising real estate prices throughout Switzerland, all properties in the canton of Zurich are due for revaluation. These have a noticeable impact on the owners due to the sharp increase.

Table of contents

ToggleRising real estate prices in the canton of Zurich – new directive

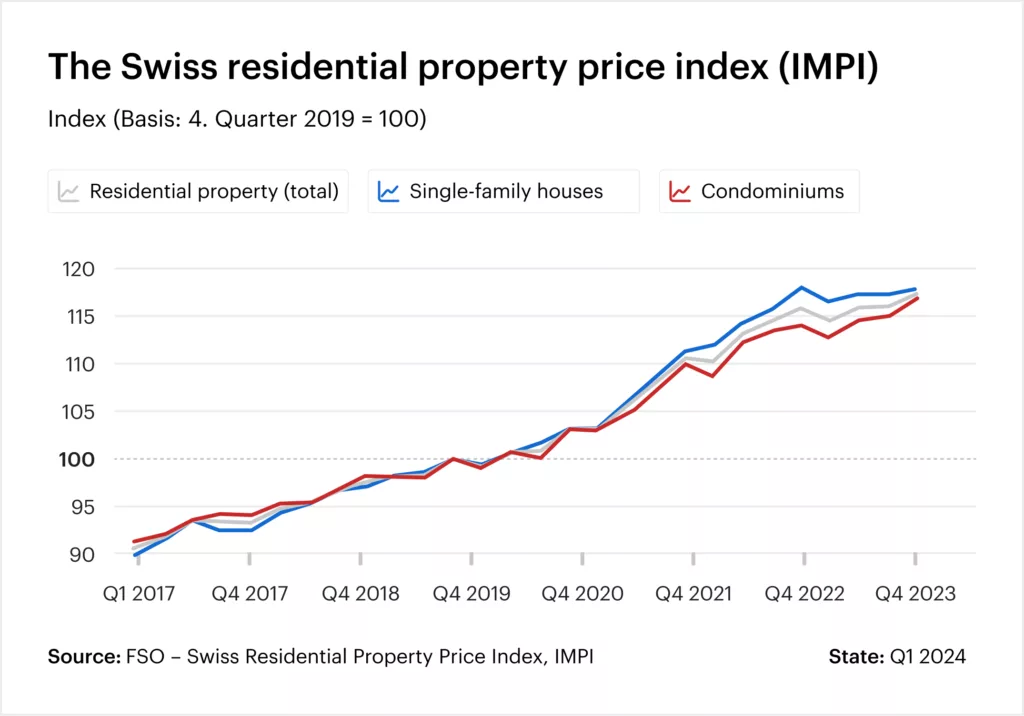

Real estate prices in Switzerland are generally rising continuously, with some exceptions. This has also increased the value of owner-occupied residential property. Following a careful review and valuation in 2009, property values in the canton of Zurich have remained unchanged over an extended period. A survey from 2021 shows a remarkable increase in property values since 2009. Since then, single-family homes and condominiums have risen by more than 50% on average, indicating a dynamic and rapidly changing real estate landscape in the Canton of Zurich.

The tax authorities have decided to revaluate all properties and determine the imputed rental value. The cantonal government has drawn up a new guideline for this, which is to come into force from the 2025 tax period.

What taxes do property owners pay in the canton of Zurich?

Wealth tax: Wealth tax is levied on the entire value of assets, including the value of the property. The value of the property is now measured according to the market value.

Imputed rental value: If the property is owner-occupied, the imputed rental value must be taxed. The imputed rental value is a notional income calculated from the market value of the property and a certain percentage (4.25% for condominiums in the canton of Zurich).

Property gains tax: Property gains tax must be paid when a property is sold. Property gains tax is levied on the profit made on the sale of the property.

What does the new directive mean for property owners?

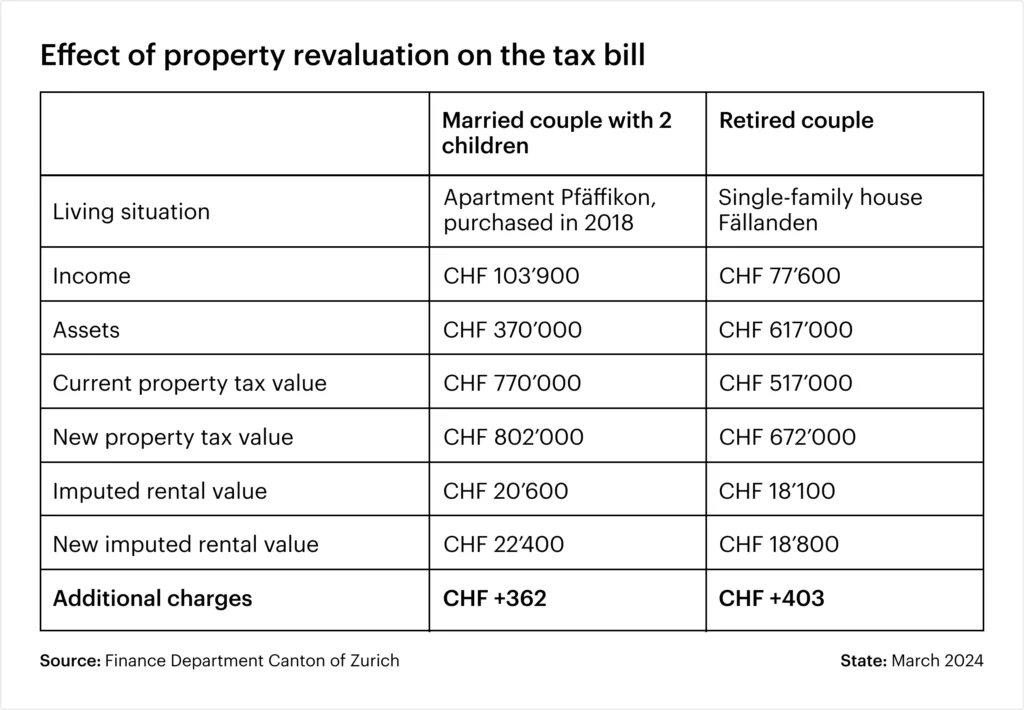

The new ordinance on real estate valuation and the determination of imputed rental values in the canton of Zurich may result in a considerable additional burden for property owners. This depends on various factors: Progression in income tax, property tax liability and date of purchase of the property. The increase will be greatest for owners who purchased their property before 2009, as they have benefited from the high increase in value in recent years.

Higher property tax value: The value of a property for property tax purposes may not be less than 70% of the current market value. The property tax rises with the increase in property value. This is because the new directive adjusts the valuation of real estate to the current market value. The market value is the price that would be achieved for a property if it were sold. It is possible that the value of the property increases to such an extent that a property tax liability arises for the first time.

Do you know the market value of your property?

Higher imputed rental value: The taxable imputed rental value may not be less than 60% of the market rent. The new directive also increases the imputed rental value. If the new imputed rental value falls into a higher progression, income tax will also increase.

What is the market rental value of your property?

An appraiser has calculated the new imputed rental values and property tax values for single-family homes and condominiums on behalf of the Finance Directorate. The results show that the values need to be increased significantly to take account of the rise in real estate prices.

Single-family houses:

Property tax value: average increase of 49%

Owner-occupied rental value: average increase of 11

Condominiums:

Property tax value: average increase of 48%

Owner-occupied rental value: average increase of 10%

Some examples of the effects of the revaluation have been calculated in the table below.

Conclusion

Imputed rental value: abolition at federal level?

The Federal Parliament has been discussing the abolition of the imputed rental value for some time. If this comes into force at federal level, it will have an impact at cantonal level and the imputed rental value will no longer apply. Despite the possible abolition of the imputed rental value, the tax office considers it necessary to adjust the property tax.

At the beginning of 2026, property owners will receive the definitive amounts for property tax and imputed rental value from their municipality, which will be relevant for the 2025 tax return.

All data are without guarantee. The information on these Internet pages has been carefully researched. Nevertheless, no liability can be assumed for the accuracy of the information provided.